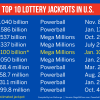

Powerball Winner NJ: New Jersey Resident Hits Jackpot in Record-Breaking Draw Top Ten Lottery

Powerball Winner NJ: New Jersey Resident Hits Jackpot in Record-Breaking Draw

Powerball Winner NJ: New Jersey Resident Hits Jackpot in Record-Breaking Draw

In a stroke of extraordinary luck, a New Jersey resident has emerged as the latest Powerball winner NJ, clinching the coveted jackpot in a draw that has shattered previous records. The thrilling announcement has sent waves of excitement across the Garden State as the lucky individual’s life stands on the brink of monumental change. With millions of eyes glued to their screens and hearts racing in anticipation, this historic win marks a momentous occasion not only for New Jersey but for lottery enthusiasts nationwide. The new Powerball millionaire’s story is one of dreams realized and fortunes transformed overnight.

The impact of the Powerball win on the local community in New Jersey is expected to be substantial. The newfound wealth of the winner has the potential to inject significant financial resources into the area, fostering economic growth and prosperity. Local businesses may see a surge in patronage as the winner begins to spend their winnings, whether on luxury items, real estate, or community projects. This increased spending can lead to job creation, higher revenues for local enterprises, and an overall boost in the local economy.

Moreover, the Powerball jackpot win can inspire a sense of hope and excitement among residents. Stories of ordinary people turning into millionaires overnight can uplift community spirits and encourage others to dream big and participate in local lotteries. The winner may also choose to give back to their community through charitable donations or investments in local infrastructure, education, or health services, further enhancing the quality of life for their neighbors.

Finally, such a high-profile win brings positive publicity to New Jersey, potentially attracting tourism and new residents who are drawn by the state’s newly bolstered image of opportunity and fortune. This can lead to long-term benefits as more people look to New Jersey as a place where dreams can come true, thereby strengthening the community’s social fabric and economic resilience.

Winning the lottery is a life-changing event, but without proper financial planning, even the largest windfall can quickly diminish. For lottery winners, the first step should be to consult with a team of professionals, including a financial advisor, tax attorney, and accountant. These experts can help create a comprehensive plan that addresses immediate needs and long-term goals. Properly managing your newfound wealth involves setting up a budget, investing wisely, and understanding the tax implications of your winnings.

One crucial aspect of financial planning for lottery winners is diversification. Instead of putting all your money into one type of investment, spread it across various assets like stocks, bonds, real estate, and high-yield savings accounts. Diversification helps mitigate risks and ensures a steady growth of your wealth over time. Additionally, setting up an emergency fund is essential to cover unexpected expenses without dipping into your primary investments.

Finally, consider your legacy and future generations by setting up trusts or estate planning. This not only secures your family’s financial future but also offers potential tax benefits. Charitable giving can also be part of your plan, allowing you to support causes you care about while benefiting from tax deductions. By taking these steps, lottery winners can ensure that their newfound wealth brings long-lasting financial security and peace of mind.

The history of Powerball jackpots in New Jersey is a compelling story of dreams turned into reality for many lucky residents. Since joining the Powerball lottery in 1992, New Jersey has produced numerous jackpot winners, with some of the most notable wins making headlines nationwide. One of the most memorable moments came in 2013 when a Bergen County resident won a staggering $338.3 million, marking one of the largest lottery prizes ever claimed in the state. These wins not only transformed the lives of the winners but also brought significant attention and excitement to the local communities.

Over the years, New Jersey has continued to be a hotspot for Powerball success, with multiple big wins contributing to its reputation as a lucky state for lottery players. The state’s lottery system has seen consistent participation, and each jackpot win serves as an inspiring story for hopefuls who dream of striking it rich. With its long history of substantial payouts, New Jersey remains a key player in the national Powerball landscape, continually fostering a sense of hope and possibility among its residents.

For those interested in trying their luck, understanding New Jersey’s rich history with Powerball jackpots provides valuable insights into the potential life-changing impact of winning. Each jackpot story underscores the importance of responsible financial planning and community involvement, showcasing how lottery winnings can create positive ripple effects throughout the state. As New Jersey continues to celebrate its Powerball successes, it remains a beacon of opportunity for aspiring millionaires everywhere.

Winning a Powerball jackpot is a moment of immense joy and excitement, not just for the winner but also for their friends and family. Immediate reactions often range from disbelief to ecstatic celebration, as loved ones come to terms with the life-changing news. Family members typically express overwhelming happiness and relief, knowing that financial worries will be significantly eased. Friends, on the other hand, often share in the jubilation, offering heartfelt congratulations and eagerly anticipating how the win could positively impact their social circles.

However, it’s crucial for winners to manage these reactions carefully. The sudden influx of wealth can strain relationships if not handled thoughtfully. Clear communication and setting boundaries can help maintain harmony among friends and family. Sharing the joy responsibly by considering financial gifts or charitable contributions can foster goodwill without causing dependency or resentment. Overall, positive and transparent interactions can ensure that everyone benefits from this extraordinary stroke of luck while preserving cherished relationships.

In summary, the reactions from friends and family to a Powerball win are a blend of joy, excitement, and anticipation. By managing these emotions wisely and maintaining open lines of communication, winners can ensure their newfound wealth brings happiness and strengthens relationships. This approach not only enriches their personal lives but also adds value to their broader community network.

The Role of Luck vs. Strategy in Winning the Lottery

When it comes to winning the lottery, the debate between luck and strategy often takes center stage. At its core, the lottery is a game of chance, meaning that luck plays a predominant role. Each draw is random, and no amount of strategy can guarantee a win. However, there are ways to optimize your approach to increase your odds slightly. For instance, purchasing multiple tickets or joining a lottery pool can improve your chances, albeit marginally. It’s important for players to understand that even with these strategies, the element of luck remains overwhelmingly dominant.

While some people try to use patterns or statistics to select their numbers, it’s crucial to remember that each draw is independent of the others. This means that previous winning numbers have no bearing on future results. Therefore, strategies like choosing “hot” or “cold” numbers are more about personal preference than scientific accuracy. What can be beneficial, though, is setting a budget for your lottery spending to ensure you play responsibly and within your means.

Ultimately, the allure of the lottery lies in its unpredictability and the dream of striking it rich overnight. While you can employ certain strategies to slightly boost your odds or make the experience more enjoyable, luck is the key factor that decides who walks away with the jackpot. By maintaining a balanced perspective and playing responsibly, you can enjoy the thrill of the game while understanding that winning is primarily a matter of chance.

Winning the lottery can be a dream come true, but it’s important to understand how lottery winnings affect taxes to avoid any financial pitfalls. In the United States, lottery winnings are considered taxable income by both federal and state governments. The IRS requires that 24% of your winnings be withheld immediately for federal taxes. However, this is just a portion of what you might owe, as the total tax liability can be much higher depending on your overall income for the year. It’s crucial to consult with a tax professional to determine your exact tax obligations and ensure you’re not caught off guard come tax season.

In addition to federal taxes, most states also impose their own taxes on lottery winnings. The rates can vary significantly from state to state, with some states like California and Delaware not taxing lottery winnings at all, while others have rates as high as 8%. Understanding your state’s tax laws will help you better plan how much of your winnings you’ll actually get to keep. By staying informed about these tax implications, you can make smarter financial decisions and avoid any unpleasant surprises.

Finally, consider the impact of your lottery windfall on other aspects of your financial life. Winning a large sum can push you into a higher tax bracket, affecting not just your lottery winnings but also other sources of income. Additionally, you may need to make estimated tax payments throughout the year to avoid penalties for underpayment. Properly managing your newfound wealth requires careful planning and professional advice to maximize your benefits while staying compliant with tax laws.

Winning the lottery provides an incredible opportunity not only to transform your own life but also to make a significant impact through philanthropy and charitable giving. Many lottery winners choose to donate a portion of their winnings to causes they care about, helping to support initiatives in education, healthcare, poverty alleviation, and more. Charitable giving not only benefits the community but also offers tax advantages, as donations to qualified organizations can be deductible on your tax return. This can help reduce the overall tax burden from your lottery windfall, making it a win-win situation for both you and the community.

To get started with philanthropy, it’s essential to identify causes that resonate with you personally. Whether it’s funding scholarships, supporting local shelters, or contributing to medical research, focusing on areas you are passionate about will make your charitable efforts more meaningful and rewarding. Setting up a donor-advised fund or a charitable trust can provide a structured way to manage your donations and ensure that your contributions are used effectively. Consulting with financial advisors and tax professionals can help you navigate the complexities of charitable giving, ensuring your generosity has the maximum impact.

In summary, philanthropic efforts after a lottery win can create lasting positive change while offering financial benefits through tax deductions. By thoughtfully selecting causes to support and utilizing strategic planning tools, you can turn your lottery windfall into a force for good, enriching both your life and the lives of others. This approach not only amplifies the joy of winning but also leaves a lasting legacy of kindness and generosity.

Winning the lottery is a life-changing event, but it’s crucial to understand the legal considerations for lottery winners to protect your newfound wealth and ensure smooth financial management. First and foremost, it’s advisable to remain anonymous if your state laws allow it. Publicizing your win can make you a target for scams and unwanted attention. Consult with a legal professional to understand your state’s privacy laws and the best strategies for keeping your identity confidential.

Another key legal consideration is setting up a trust or an LLC to claim your winnings. This not only offers an additional layer of privacy but also provides legal protection against potential lawsuits. A trust can help manage your assets more effectively and ensure that they are distributed according to your wishes, both during your lifetime and after. An LLC can offer similar benefits while also providing some tax advantages depending on your state laws.

Lastly, it’s essential to be aware of any tax obligations tied to your lottery winnings. Both federal and state taxes apply, and failing to pay them can result in severe penalties. Work with a tax attorney or an accountant to understand your responsibilities and plan for them accordingly. By addressing these legal considerations proactively, you can protect your assets, maintain your privacy, and enjoy your winnings with peace of mind.

When you win a lottery prize, one of the critical decisions you’ll face is whether to claim your winnings publicly or privately. Publicly claiming your prize means that your name, and often other personal details, will be made available to the public. This can lead to instant fame but also exposes you to potential risks such as scams, unsolicited requests for money, and loss of privacy. Some states require winners to come forward publicly as a measure of transparency and to build trust in the lottery system.

On the other hand, claiming your prize privately can offer significant advantages in terms of security and peace of mind. If your state allows it, you can set up a trust or an LLC to claim the winnings on your behalf. This keeps your identity confidential and helps protect you from unwanted attention. It’s essential to consult with legal and financial advisors to ensure you comply with local laws while maximizing your privacy.

Ultimately, the choice between public and private claiming of lottery prizes depends on your personal circumstances and preferences. Weigh the benefits of public recognition against the need for privacy and security. By making an informed decision, you can better manage your newfound wealth while safeguarding your personal life.

Powerball winner NJ